Published on:

8 min read

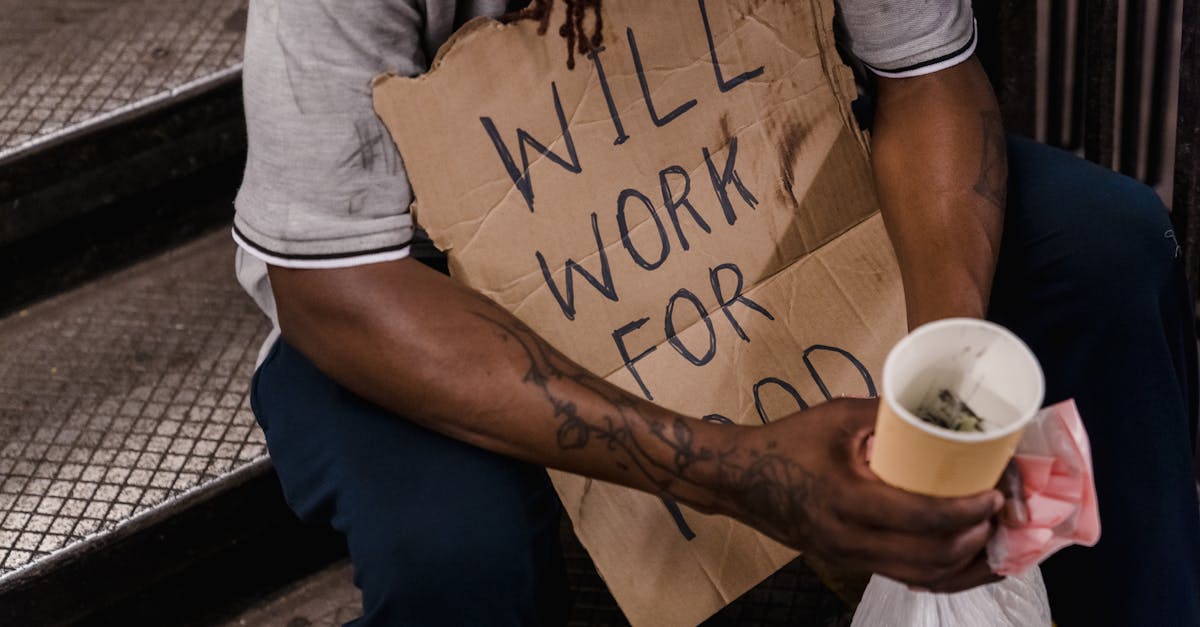

Smart Money Moves: Your Guide to Financial Assistance and Support

In today's economic landscape, navigating financial support options can feel overwhelming. This guide highlights smart money moves to help you secure the financial assistance you need for a more stable future.

Understanding Financial Assistance Programs

Financial assistance programs are designed to support individuals and families facing economic hardships. These programs vary by country, state, and localities, often providing services such as food assistance, housing vouchers, and utility support. Understanding the various types of assistance available is the first step in making smart financial decisions. Start by researching government-run programs such as the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF). Nonprofit organizations and local charities also offer support that can alleviate financial burdens. Creating a list of potential resources available in your area will give you a clearer picture of your options.

Crafting a Budget that Works

Creating a realistic budget is crucial in your journey toward financial stability. Begin by tracking your income and expenses for a month to identify spending patterns. Categorize your expenses into needs and wants. This approach helps you distinguish between essential bills and discretionary spending. Allocate a portion of your income toward savings to create a cushion for emergencies. Consider employing the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings/debt repayment. Regularly review your budget to adapt to changing circumstances, ensuring it remains an effective tool for managing your finances.

Leveraging Community Resources and Support

In addition to governmental assistance, community resources can play a significant role in financial support. Many cities offer services such as free counseling, financial literacy workshops, and job training programs. Local libraries, community centers, and nonprofits often host workshops to enhance your skills and knowledge about personal finance and career development. Furthermore, engaging with these community services can connect you with individuals facing similar challenges, fostering a support network. Joining local groups or online forums focused on financial well-being can inspire you with stories of resilience and success, showing you that you are not alone in your financial journey.

Conclusion

Navigating financial challenges can be daunting, but with the right resources and a solid plan, you can make informed decisions that lead to a brighter financial future. By understanding available assistance options, crafting a budget, and utilizing community resources, you empower yourself to make smart money moves. Remember, seeking help is a sign of strength and an important step in your journey toward financial security.

Published on .

Share now!